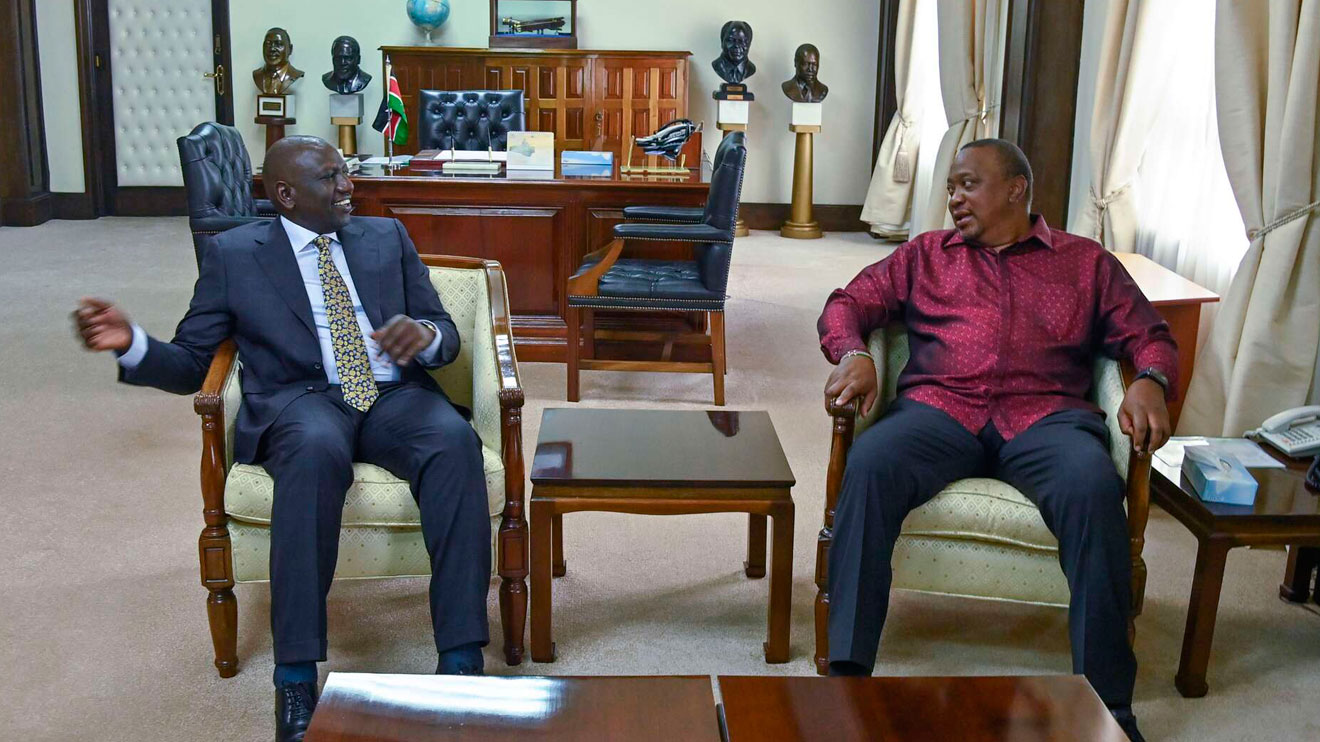

Tax burden: Why Kenyans are ‘not celebrating’ Ruto’s first year in office

As President William Ruto marks his first year in office, Kenyans find themselves in a perplexing state of mind.

The celebratory mood that greeted his election victory in his political strongholds has long been subdued and overtaken by the rising cost of living.

President Ruto assumed office in September last year, but his administration’s introduction of stringent tax measures has left many citizens grappling with the rising cost of living. Instead of jubilation, apprehension has taken hold.

On June 26, 2023, the Head of State signed a bill into law that raised taxes on a wide range of items, a move that has drawn criticism for potentially exacerbating economic hardships for citizens.

Also read: Raila’s lieutenants decry tax burden on Kenyans

A significant point of contention was the hike in the value-added tax (VAT) on gasoline, which surged from 8 per cent to 16 per cent.

This increase has had a cascading effect on the country’s economy, pushing up the prices of goods, as diesel and petrol costs loom large in production and transportation.

Another contentious issue was the Housing levy, initially proposed at 3 per cent but eventually settled at 1.5 per cent of the gross pay after being reclassified as a tax.

Also read: Moses Kuria trends in Kenya while Adan Mohamed ‘takes over’ his duties in America

Social media influencers, who often promote brands and digital content, were not spared either. They are now required to pay a 5 per cent withholding tax on their gross revenue.

Betting and insurance are also feeling the tax effects, with withholding taxes set at 12.5 per cent and 16 per cent respectively. These measures have left many questioning their financial future.

In the Treasury’s Medium Term Revenue Strategy 2024/25 – 2026/27, some of the proposals that are expected to have a huge impact on businesses and consumers include a review of the Value Added Tax (VAT) rate to bring it in line with other East African Community (EAC) states and a review of the excise duty on fuel products.

All these changes are expected to impact ordinary Kenyans, with the government targeting an annual revenue of Sh650 billion.

In explaining these changes, the Treasury has acknowledged the trade-offs inherent in tax incentives. While they can shape taxpayers’ behavior, they come at the cost of forgone tax revenue.

Also read: Senator Gloria Orwoba hangs out with Prince Harry at Invictus Games

Moreover, they can complicate the tax system and undermine its equity. Some studies even question their effectiveness in influencing taxpayer behavior.

President Ruto’s first year in office, marked by these tax reforms, has left many Kenyans facing tough financial times.

The long-term impact of President Ruto’s taxation measures remains to be seen, making his second year in office all the more critical in the assessment of his leadership.

However, it is also good to note that the President has delivered to Kenyans some of his promises such as the subsidized fertilizer and the Hustler Fund.

Also read: Charles Keter’s comeback – Former Energy CS appointed Ruto’s advisor